If you want to know more information (such as product/process price, etc.), please contact us 24-hour telephone

Copper’s no longer just some everyday industrial stuff – it’s turned into a downright strategic metal everybody’s fighting over, thanks to the whole world rushing toward green energy. The hunger for it is exploding because of electric cars, wind and solar farms, beefed-up power grids, data centers, you name it. That makes producing copper in a responsible way more crucial than it’s ever been.

Yet pretty much every forecast out there screams we’re heading straight into a massive shortfall by 2030. That spells both fat opportunities and some serious headaches for anyone in the business. What follows is a no-nonsense rundown to help you make sense of this crazy market – from rocks in the dirt all the way to fat returns, covering geology basics, plant build-out, must-have gear, and real-world projects that actually happened.

Picture the whole copper game like a long, gritty assembly line: you dig rock out of the earth and somehow end up with shiny, pure metal ready to ship. In super simple terms, the steps pretty much always go: Exploration → Mining (Open Pit or Underground) → Crushing & Grinding → Concentration → Smelting → Refining → Cathode Copper.

The extraction of copper is fundamentally dictated by the mineralogy of the ore, which directly determines the processing method, cost, and final metal recovery.

Sulfide ores, primarily chalcopyrite, are efficiently processed via crushing, grinding, and flotation to produce a smelter-bound concentrate, achieving high recoveries of 85-94%.

Oxide ores like malachite require a completely different hydrometallurgical approach using acid leaching followed by solvent extraction and electrowinning to produce cathode copper. However, recoveries are more variable (60-80%) and sensitive to clay content.

Mixed ores, containing both sulfide and oxide minerals, present significant complexity and risk and often require sequential or hybrid circuits.

Polymetallic ores (e.g., Cu-Au, Cu-Mo) demand complex flowsheets to maximize recovery of all valuable metals, while refractory, clay-rich ores create severe operational challenges in both flotation and leaching, necessitating specialized technology and strategies.

Comparison between oxidized copper ore and sulfide copper ore

Best fit: Hands-down the go-to choice whenever you’ve got a huge, flat-lying, not-too-rich porphyry sitting close to the surface.

Upfront cash burn: You get hammered right from the start – massive pre-strip, roads everywhere, power lines, workshops, and a whole army of giant toys.

Gear you’ll see: Monster drill rigs, rope shovels or big hydraulic excavators, and those ridiculous 400-tonne trucks that look like toys next to the hole.

Main tricks up the sleeve: Sublevel stoping when the ore stands up steep and proud, cut-and-fill if it’s rich but all over the place, block caving when it’s deep, massive, and you’re happy to let gravity do most of the work.

Money side: You dodge the insane startup bill you’d get topside, but holy cow the daily running costs add up fast – rock bolts, giant fans sucking air miles underground, hoists, pumps, you name it.

Where it makes sense: Stuff that’s buried deep, runs rich enough to justify the hassle, or simply too shaky for a giant crater.

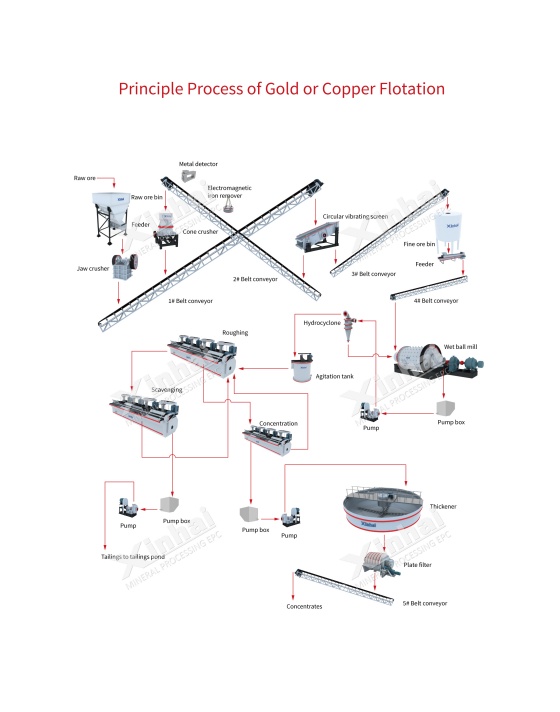

Objective: Reduce Run-of-Mine (ROM) ore to a consistent size for grinding.

Process: A three-stage circuit (Primary→Secondary→Tertiary crushing) with screening.

Key Impact: Efficient crushing ("crush more, grind less") significantly reduces downstream grinding energy, the plant's largest energy consumer.

Objective: Liberate copper minerals via grinding to a target P80 (e.g., 150µm).

Equipment: SAG/Ball Mills for grinding; Hydrocyclones for classification.

Focus: Energy optimization through mill design, media, and advanced process control.

Objective: Separate copper minerals from gangue using physio-chemical means.

Circuit: Rougher → Scavenger → Cleaner flotation cells.

Key Elements: Tailored reagent regime and advanced techniques like coarse particle flotation for efficiency.

Objective: Solid-liquid separation to recover water and produce a handleable concentrate or tailings.

Equipment: Thickeners, vacuum filters, and pressure filters.

Key Challenge: Managing high-clay ores with specialized thickeners, flocculants, and filter types.

Leaching: Copper is dissolved from ore using acid via Heap or Agitated leaching.

Solvent Extraction (SX): Purifies and concentrates copper from solution.

Electrowinning (EW): Uses electricity to plate out 99.99% pure cathode copper.

oxide ores processing case: a Large Copper Mine EPC Project in Kazakhstan

Smelting: Flash smelting converts concentrate into copper matte (~65% Cu) and slag.

Converting: Matte is oxidized to form blister copper (98-99% Cu).

Refining: Electrorefining purifies blister copper into 99.99% cathode copper, recovering precious metals.

| Ore Type | Best Processing Route | Key Determinants | Expected Cu Recovery | Relative Cost Level |

|---|---|---|---|---|

| Simple Sulfide | Crush→Grind→Flotation→Smelt | High sulfide content; Liberatable at coarse grind | 85-94% | Medium |

| High-Grade Oxide | Crush→Agitated Leach→SX-EW | High acid solubility; Low clay content | 85-90%+ | Low-Medium |

| Low-Grade Oxide | ROM/CRUSH→Heap Leach→SX-EW | Permeable ore; Suitable for stacking | 60-80% | Low |

| Mixed Ore | Sequential Process: Leach (Oxides) → Flotation (Sulfides) | Oxidation ratio; Mineralogical balance | 75-88% (overall) | Medium-High |

| Clay-Rich Ore | Pre-treatment (Scrubbing/Desliming) + Adapted Flotation or Leach | Clay content >15-20%; Filtration index | Variable, can drop 5-15% | High |

| Polymetallic (Cu-Mo) | Selective (Differential) Flotation → Separate Concentrates | pH control; Use of specific depressants (e.g., for pyrite/Mo) | Cu: 85-92%; Mo: 50-70% | High |

A rigorous financial model is the foundation of project viability, translating technical designs into investor-ready economics and defining the path to profitability.

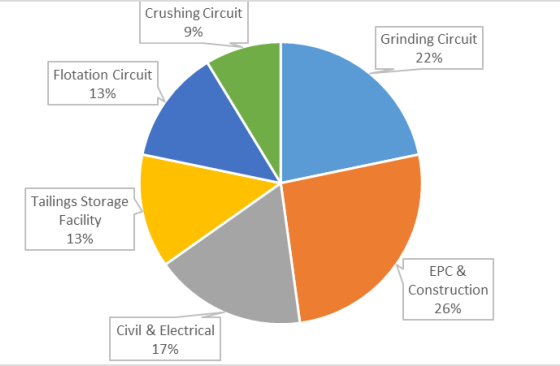

This is the upfront capital required to design and construct the facility, expressed as USD per annual tonne of copper. Major components include the Grinding Circuit (15-25% of plant CAPEX, often the largest single item), Tailings Storage Facility (10-20%+, costs rising with modern standards), and integrated EPC & Construction costs (20-30%). Other significant outlays cover Crushing (5-10%), Flotation (10-15%), and Civil/Electrical works (15-20%).

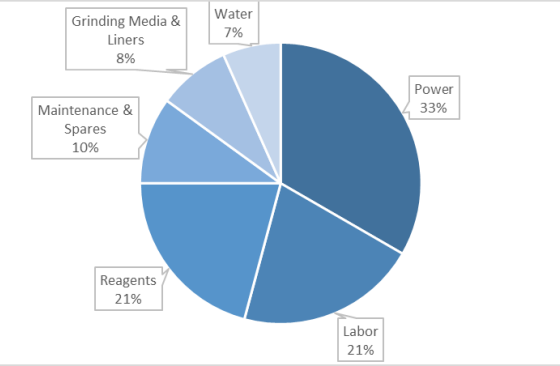

These are the ongoing costs of production, measured per tonne of ore or pound of copper. The largest component is Power (25-40% of OPEX), driven primarily by grinding and electrowinning. Other major costs are Reagents (10-25%, especially acid for leaching), Labor (15-25%, varying by location), and consumables like Grinding Media (5-10%). Water costs (3-8%) and Maintenance (8-12%) are also critical operational drivers.

Investors rely on Net Present Value (NPV) and Internal Rate of Return (IRR) as key metrics, with a typical hurdle rate of 15-20% for greenfield projects. Sensitivity analysis is crucial: Copper Price is the most significant variable, Metallurgical Recovery (where a 1% change can impact NPV by 2-4%) is a key leverage point, and Treatment Charges (TC/RCs) directly squeeze margins for concentrate producers, potentially rendering marginal projects uneconomic.

Most mining projects bleed money and stumble hard because everyone’s doing their own thing – a dozen vendors all pointing fingers when stuff hits the fan. Handing the whole mess to one proper EPC crew changes the game completely. They take it from scratch: lab runs that actually prove the flowsheet, picking gear that won’t embarrass you, building the plant, commissioning it, and even promising they’ll still answer the phone ten years later when you need a weird spare part. Nothing falls between the cracks because there’s only one throat to choke.

For anyone writing the checks, this is pure painkiller. Fixed-price lump-sum means the “oops we’re 40% over budget” surprise never lands on your desk. All the scary decisions about process route or which brand of mill get locked in after real testwork, not some consultant’s PowerPoint dream. Basically you shove the entire headache – delays, screw-ups, start-up nightmares – over to people who do this for a living, and in return you get a plant that hits nameplate numbers pretty much on the day they hand you the keys. It’s less of a construction contract and more of an insurance policy with cathodes attached.

Whether you’re evaluating a new copper deposit, expanding an existing plant, or looking for a more efficient processing route, Xinhai Mining provides a fully engineered solution backed by 20+ years of EPC experience and 2,000+ global mineral processing projects.